The Solution

Empowering the financial journey of freelancers and help them save more on taxes.

Positioning the feature: It's crucial for us to uphold FlyFins' role as a tax service app, so the introduction of a finance tracking feature should be carefully integrated with tax-related functions.

The MVP mindset: We're navigating uncertainty about what will succeed and what won't. Our goal is to develop a product that delivers user value without compromising the craftsmanship of the product.

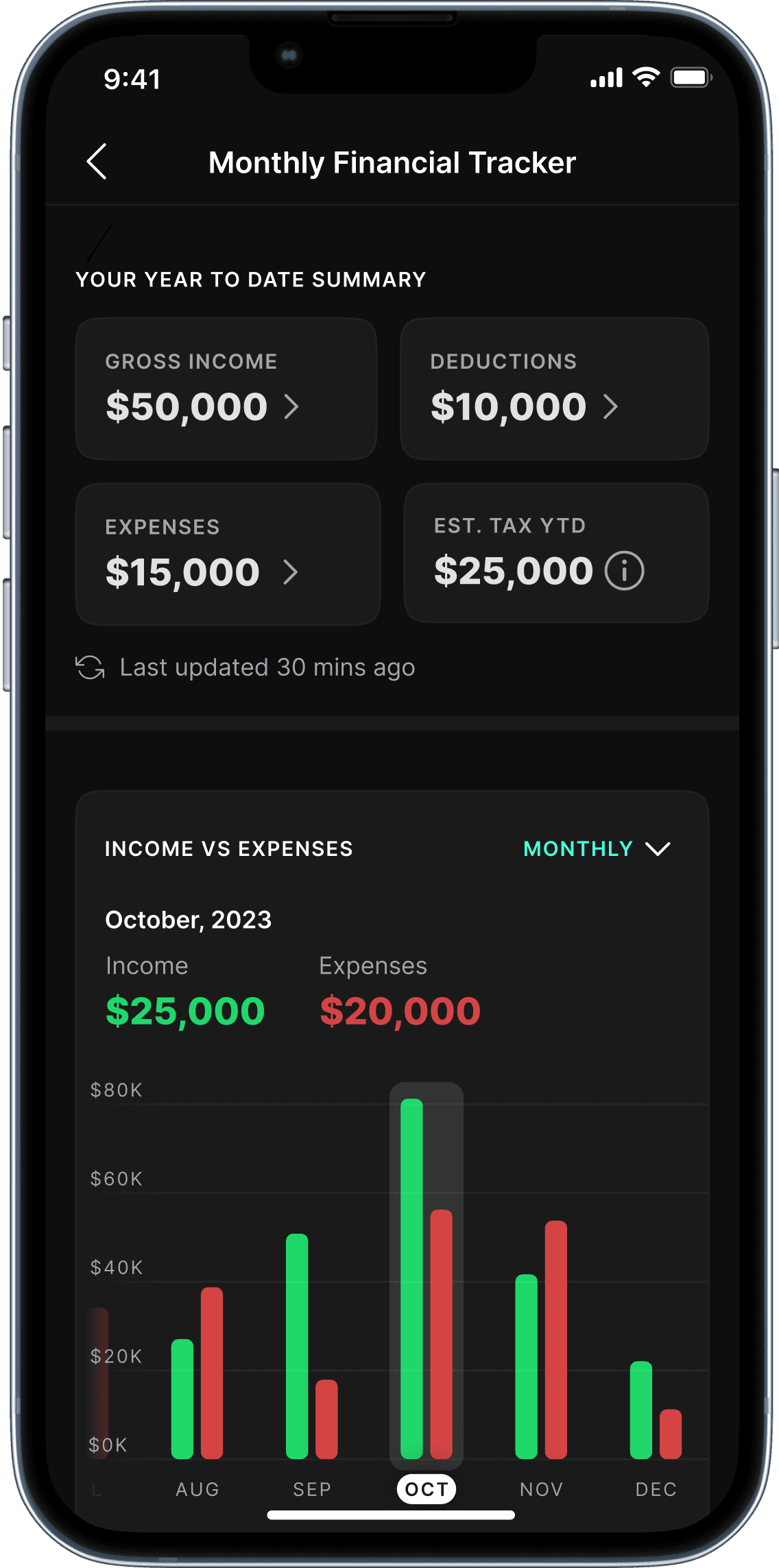

A sneak-peak

After countless brainstorming sessions and iterations, we’ve crafted a solution that perfectly aligns with our goals and design principles. Ready for a sneak peek? Here it is!

On-boarding

To enhance discoverability, we experimented with an unobtrusive bottom sheet to announce the launch of the feature.

We also implemented ongoing discovery of the feature through a home page widget, persisting even after dismissing the bottom sheet.

Accuracy & efficiency

Implemented swipe interactions similar to Tinder for accepting and rejecting income.

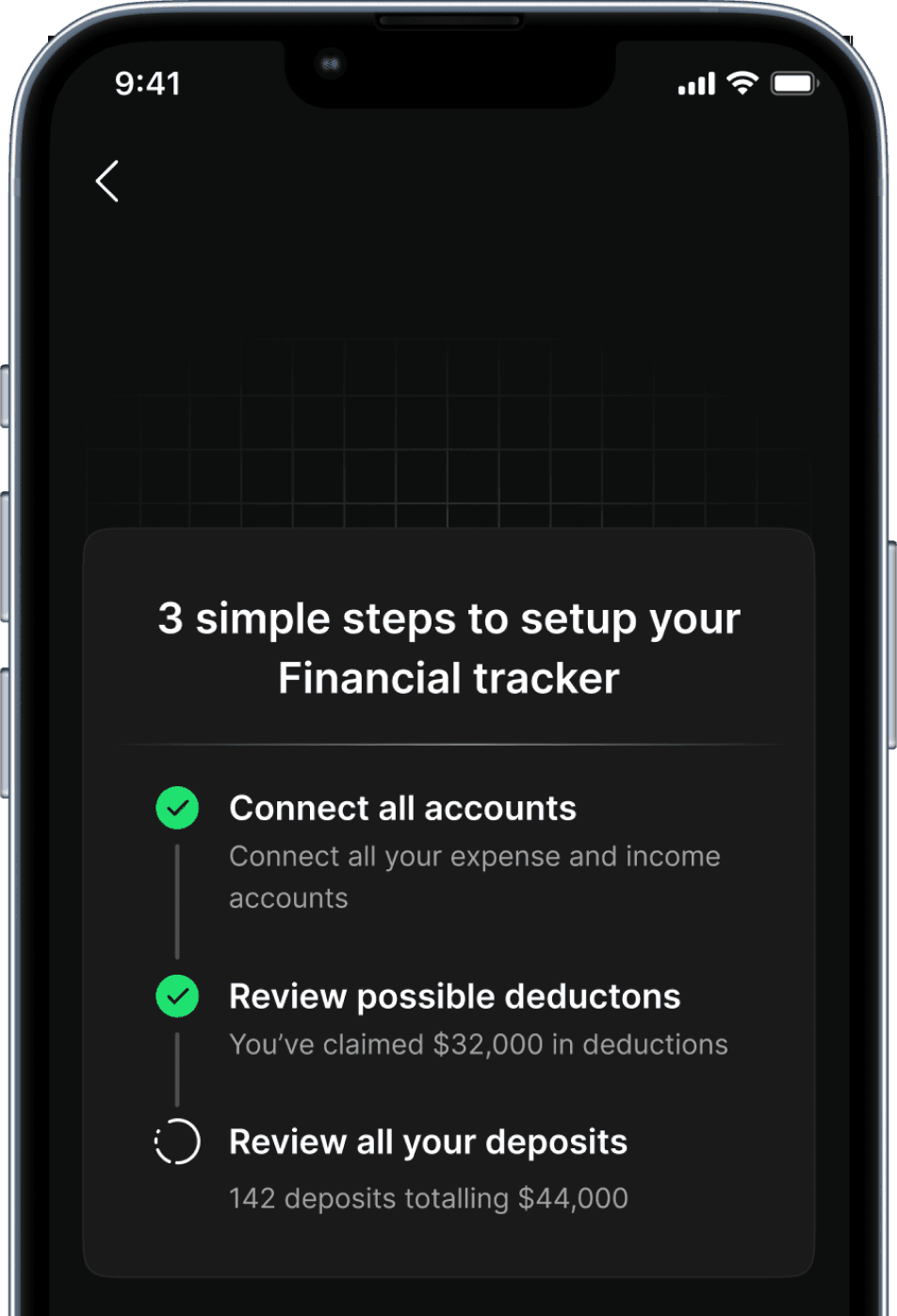

Give guidance & show progress

Displaying the user's current status and outlining remaining tasks.

Show status

Display the total detected deposits to set appropriate expectations for users as they proceed.

Result & Impact

3 months of data (Aug ‘23 - Nov ‘23) after the release.

~0%